Average Mortgage Interest Rates – Canadian Historical Rates – You may see the

Current ‘posted’ mortgage interest rates

As of Saturday, April 27th, 2024 the Bank Prime Rate is

| Current Bank Prime Lending Rate is 7.20% |

Compare over 500+Canadian mortgage rates now

| Term | Rate | |

|---|---|---|

| 1 Yr Closed | 7.04% | |

| 2 Yr Closed | 5.99% (special Offer) | |

| 3 Yr Closed | 6.21% (on sale) | |

| 4 Yr Closed | 5.79% | |

| 5 Yr Closed | 5.39% (on sale) | |

| 5 Yr Variable (TD Prime -0.40%) | 6.95% (on sale) | |

| Current Bank of Canada Prime Rate |

|

|

| Current Bank Lending Prime Rate |

|

|

What does the term BANK PRIME RATE really mean? Use this link to see the current bank prime As of Saturday, April 27th, 2024 ) the Overnight Rate is

The Bank Prime Rate is the rate that Canadian banks charge their absolute best customers for loans. Changes in the Bank of Canada prime rate influence changes in other interest rates, including variable interest rate mortgages. The prime rate fluctuates based on economic conditions. Some mortgage companies offer interest rates starting at less than bank prime rate as an incentive to borrow from them! These are known as “SUB PRIME” Mortgages and we know what happened in the US when too many sub-prime mortgages were given out in the mid 2000’s Read more about Sub-Prime Mortgages The Graph(s) below show you interest rate trends in the past |

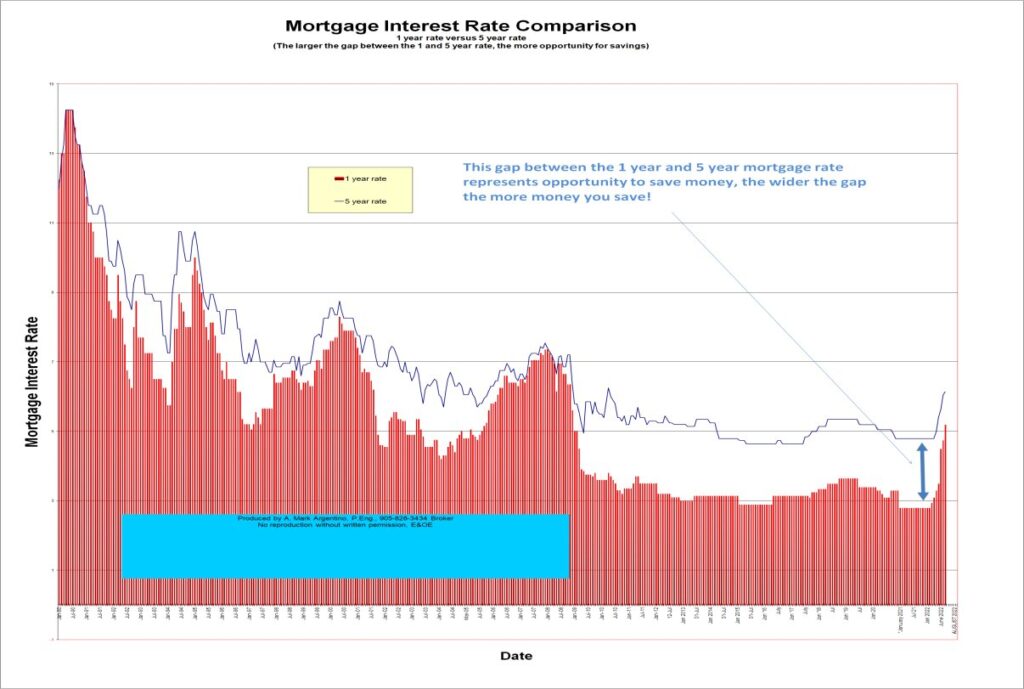

Send Mark an E-mail or you can call me now at 905-828-3434 This is an excellent link to view and compare Today’s Low Canada and Ontario Current Mortgage Interest rates from major lenders for discounted, variable, fixed and prime rates in Canada and a mortgage calculatorClick graph below to open a full size detailed image in new window This link will take you to another page showing a graph of the 5 year posted mortgage interest rate since 1951 Should I go short or long term on my mortgage – comparison of rates over timeYou can compare Short or long term mortgage rates here. Another very interesting relationship is how the 1 year and 5 year mortgage interest rates compare over time. People often ask me if they should choose the short term rates or lock in for the long term rates with their mortgage. The answer is not simple and often depends upon your personal situation and your risk tolerance, read more about locking in your mortgage for the long or short term. The graph below may give you some insight into what you may wish to do by comparing the difference between the short and long term rates over the past decade or so and how the difference fluctuates. Click graph below to open a full size detailed image in new window Mortgage Interest rates are still very low compared to previous decades! Mortgage Calculator Canada Find the current BEST MORTGAGE Rates Here OR you can find A mortgage that’s right for you from the lowest to highest and Current mortgage rates. Fixed rate and variable Canadian mortgages, Mortgage Rate Directory, Low Mortgage Rates, Today’s Mortgage Rates, Discounted Mortgage Rates, Mortgage Rate info, Mortgage Tips & Advice, Ontario Mortgage Rates and more at this best rate page. 26 Excellent Articles about Buying or Selling your home and selecting a realtor |

What are the financial markets in Canada and the US currently trading at?

This link will take you to CREA interest rate statistics

How does the Bank of Canada Set the Prime Rate and Interest Rates?

Excellent, I am ready to begin my home search

|

Mississauga MLS Real Estate Properties & MLS.CA Homes for Sale | All Pages including Mississauga Real Estate Blog all maintained by mark@mississauga4sale.com Copyright © A. Mark Argentino, P.Eng., Broker, RE/MAX Realty Specialists Inc., Brokerage, Mississauga, Ontario, Canada L5M 7A1 (905) 828-3434 First created – Tuesday, July 16th, 1996 at 3:48:41 PM – Last update of this page: Saturday, April 27th, 2024

At this Mississauga, (Erin Mills, Churchill Meadows, Sawmill Valley, Credit Mills and or Meadowvale ) Ontario, Canada Real Estate Property Internet web site you will find relevant information to help you and your family.