|  |  |  |  |

Report on last months NewsGTA Resale Housing Sales Up |

|

|

Report as of Monday, March 6, 2023In this Issue of my newsletter |

This is the report for latest month in real estate sales from the Toronto Regional Real Estate Board and indicates a 'normal' amount of activity and price levels.

Below is the latest release of figures

Highlights of the latest report from TRREB for the Residential Real Estate Market in the GTA Real Estate Prices DOWN and Sales Volume DOWN - Mississauga and GTA Real Estate Newsletter March 2023 - Issue 03:13 This months Real Estate Update brings more market news from our real estate market here in Mississauga, Toronto and the GTA. Enjoy and I wish you all the best! Mark

See more at this page about average prices and read the TRREB full price and data report below. |

|||

PRESS RELEASE: Sales & Price Growth Continue last monthSee the full press release above.

Please refer to this page to see a graph of Average prices and More |

|||

This is the full price and data report from TRREB for last monthGTA REALTORS® RELEASE MONTHLY RESALE HOUSING MARKET FIGURES TRREB RELEASES RESALE MARKET FIGURES AS REPORTED BY GTA REALTORS® GTA REALTORS Release February Stats TORONTO, ONTARIO, MARCH 3, 2023 – February sales in the Greater Toronto Area (GTA) were down substantially from the pre-rate hike levels of early 2022. However, the number of new listings also dropped substantially year-over-year. The result was that the average selling price and MLS® HPI continued to level off after trending lower through the spring and summer of last year. “It has been almost a year since the Bank of Canada started raising interest rates. Home prices have dropped over the last year from the record peak in February 2022, mitigating the impact of higher borrowing costs. Many homebuyers have also decided to purchase a lower priced home to help offset higher borrowing costs. The share of home purchases below one million dollars is up substantially compared to this time last year,” said Toronto Regional Real Estate Board (TRREB) President Paul Baron. GTA REALTORS® reported 4,783 sales through TRREB’s MLS® System in February 2023 – down 47 per cent compared to February 2022, the last full month before the onset of interest rate hikes. The number of new listings entered into the system was down by a similar annual rate of 40.9 per cent to 8,367. “New listings continued to drop year-over-year in the GTA. Recently released Ipsos polling suggests buying intentions have picked up for 2023. This increased demand will run up against a constrained supply of listings and lead to increased competition between buyers. This will eventually lead to renewed price growth in many segments of the market, especially those catering to first-time buyers facing increased rental costs,” said TRREB Chief Market Analyst Jason Mercer. The average selling price for February 2023 was $1,095,617 – down 17.9 per cent compared to February 2022. Some of this decline is attributable to the fact that the share of sales below $1,000,000 was 57 per cent in February 2023 versus only 38 per cent a year earlier. On a monthly basis, the average price followed the regular seasonal trend, increasing relative to January 2023. The MLS® Home Price Index (HPI) Composite Benchmark was down year-over-year by a similar annual rate of 17.7 per cent, but was also up on a monthly basis. “As we move toward a June mayoral by-election in Toronto, housing supply will once again be front and centre in the policy debate. New and innovative solutions, including the City of Toronto’s initiative to allow duplexes, triplexes and fourplexes in all neighbourhoods citywide, need to come to fruition if we are to achieve an adequate and diverse housing supply that will support record population growth in the years to come,” said TRREB Chief Executive Officer John DiMichele. Mark |

|||

See the seasonal trends in graphical form

I hope this finds you Happy and Healthy!

All the Best!

Mark

Read about Housing market indicators from last month

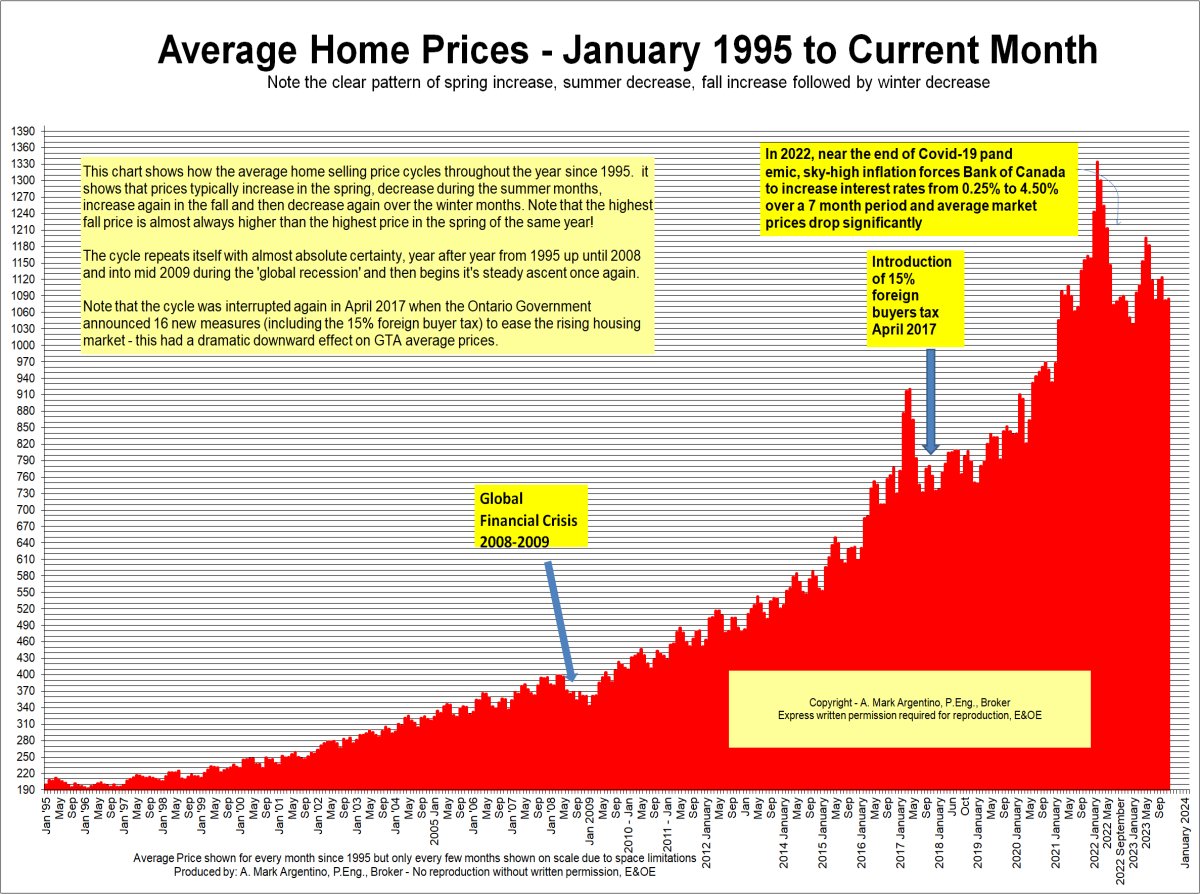

Below is a Graph showing TRREB Historical Average Price Data

|

|

|

See the Average Price Cycles from January 1995 to Date - a very interesting cyclical pattern is clearly seen!

See how the historical 1 year mortgage interest rate compares to the 5 year rate

This graph shows the 1989 real estate recession in the GTA and how long it took to recover from the drop in the average price from the peak price in February of 1989 to 2002

Statistics Canada, Quarter-over-quarter growth, on an annual basis, Statistics Canada, Year-over-year growth for the most recently reported month, Bank of Canada, Rate from most recent Bank of Canada announcement Bank of Canada, Rates for most recently completed month

Of Mississauga’s 240,660 households, 66,655 or 27.7 per cent were renters in 2016, earning an annual income of $58,272. The average cost of rent and utilities per month for Mississauga renters came in at $1,281 compared to $1,109 for the rest of Ontario.

Notes

1. Sales, dollar volume, average sale prices and median sale prices are based on firm transactions entered into the TRREB MLS® System between the first and last day of

the month/period being reported.

2. New listings entered into the TRREB MLS® System between the first and last day of the month/period being reported.

3. Active listings at the end of the last day of the month/period being reported.

4. Ratio of the average selling price to the average listing price for firm transactions entered into the TRREB MLS® System between the first and last day of the month/period

being reported.

5. Average Listing Days on Market (Avg. LDOM) refers to the average number of days sold listings were on the market. Average Property Days on Market (Avg. PDOM) refers

to the average number of days a property was on the market before selling, irrespective of whether the property was listed more than once by the same combination of

seller and brokerage during the original listing contract period.

6. Active Listings at the end of the last day of the month/period being reported.

7. Past monthly and year-to-date figures are revised on a monthly basis.

8. SNLR = Sales-to-New-Listings Ratio. Calculated using a 12 month moving average (sales/new listings).

9. Mos. Inv. = Months of Inventory. Calculated using a 12 month moving average (active listings/sales).

10. "Bradford West Gwillimbury" is referred to as "Bradford" and "Whitchurch-Stouffville" is referred to as "Stouffville" in the report

Historic Sales Figures

Rental Market indicators in the GTA

Mississauga MLS Real Estate Properties & MLS.CA Homes for Sale | All Pages including Mississauga Real Estate Blog all maintained by info@mississauga4sale.com Copyright © A. Mark Argentino, P.Eng., Broker, RE/MAX Realty Specialists Inc., Brokerage, Mississauga, Ontario, Canada L5M 7A1 (905) 828-3434 First created - Tuesday, July 16th, 1996 at 3:48:41 PM - Last Update of this website: Thursday, June 1, 2023 6:45 AM

At this Mississauga, (Erin Mills, Churchill Meadows, Sawmill Valley, Credit Mills and or Meadowvale ) Ontario, Canada Real Estate Homes and Property Internet web site you will find relevant information to help you and your family.

Why Subscribe? You will receive valuable Real Estate information on a monthly basis - such as: where to find the 'best' mortgage interest rates, Power of Sale Properties and graphs of current house price trends. Plus, you will pick up ideas, suggestions and excellent real estate advice when you sell or buy your next home.

Read Past Newsletters before you decide |