|  |  |  |  |

Report on last months NewsGTA Resale Housing Sales Up |

|

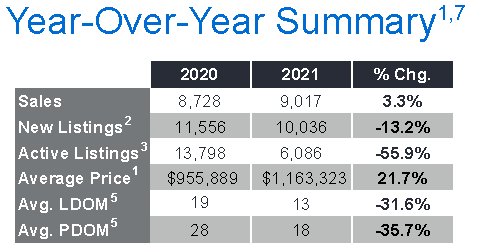

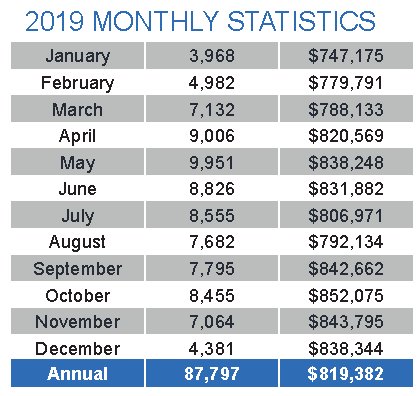

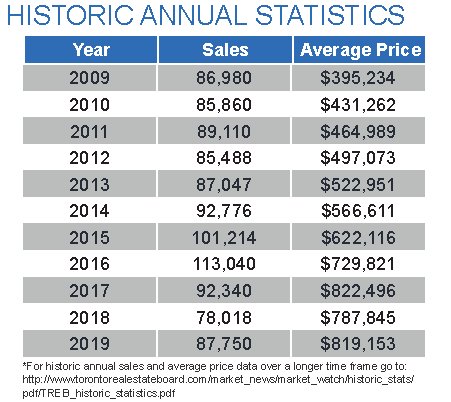

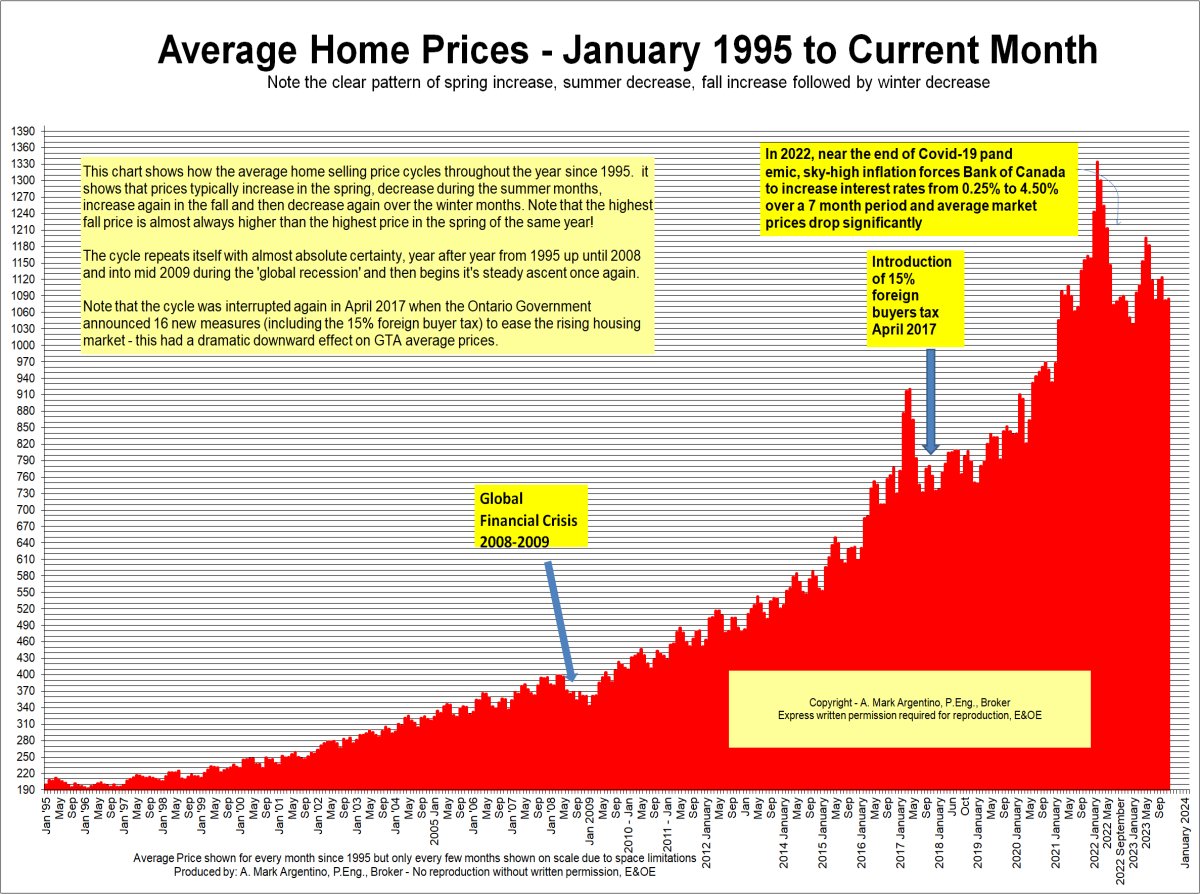

This charts below show the historical annual price and sales volumes to current month:

|

Report as of Wednesday, December 8, 2021In this Issue of my newsletter |

This is the report for latest month in real estate sales from the Toronto Regional Real Estate Board and indicates a 'normal' amount of activity and price levels.

Below is the latest release of figures

Highlights of the latest report from TRREB for the Residential Real Estate Market in the GTA Real Estate Prices UP and Sales Volume UP - Mississauga and GTA Real Estate Newsletter December 2021 - Issue 12:09 This months Real Estate Update brings more positive news from our real estate market here in Mississauga, Toronto and the GTA. Enjoy and I wish you all the best! Mark

See more at this page about average prices and read the TRREB full price and data report below. |

|||

PRESS RELEASE: Sales & Price Growth Continue last monthSee the full press release below. Please refer to this page to see a graph of Average prices and More |

|||

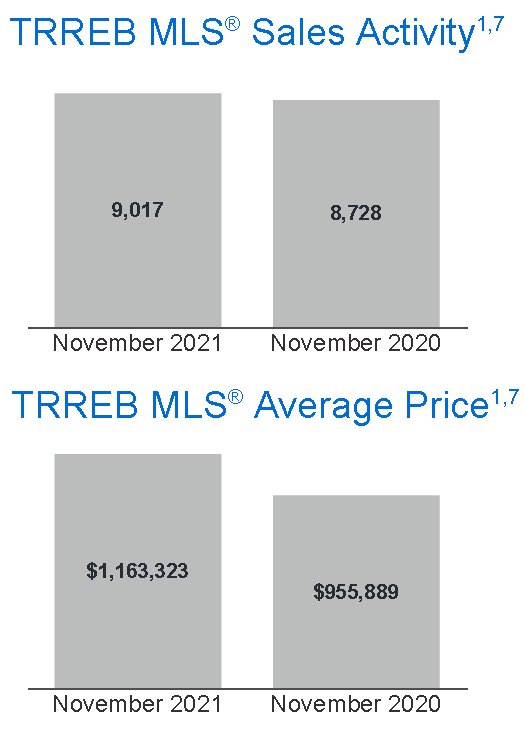

This is the full price and data report from TRREB for last monthGTA REALTORS® RELEASE MONTHLY RESALE HOUSING MARKET FIGURES TRREB RELEASES RESALE MARKET FIGURES AS REPORTED BY GTA REALTORS® GTA HOME SALES HIT NEW NOVEMBER RECORD WHILE LISTINGS DROP TRREB Calls for Action on Housing Supply Crunch TORONTO, ONTARIO, December 3, 2021 – Home sales reached a new record for the month of November, and the average selling price also reached a new all-time high. New listings were down substantially compared to last year for all market segments – further highlighting the inherent supply issue across all home types in the Greater Toronto Area (GTA). GTA REALTORS® reported 9,017 home sales through TRREB’s MLS® System in November 2021 – 3.3 per cent above the November 2020 result, setting a new record. In contrast, new listings were down by 13.2 per cent year-over-year, with double-digit declines for low-rise home types and condominium apartments. The MLS® Home Price Index composite benchmark was up by 28.3 per cent year-over-year in November 2021. The average selling price for all home types combined was $1,163,323 – up by 21.7 per cent compared to November 2020. “Governments at all levels must take coordinated action to increase supply in the immediate term to begin addressing the supply challenges of today, and to work towards satisfying growing demand in the future. The GTA remains the primary destination for new immigrants and is at the centre of the Canadian economy. For far too long, governments have focused on short-term bandaid policies to artificially suppress demand. Current market activity highlights decisively that these policies do not work, and unless governments work together to cut red tape, streamline the approval processes, and incentivize mid-density housing, ongoing housing affordability challenges will escalate. On this point, we commend the City of Toronto for moving forward with initiatives to facilitate the creation of more mid-density home types, including their current consultations on options to encourage more multiplex development across the city,” said TRREB President Kevin Crigger. “A key difference this year compared to last year, is how the condo segment continues to tighten and experience an acceleration in price growth, particularly in suburban areas. This speaks to the broadening of economic recovery, with first-time buyers moving back into the market in a big way this year. The condo and townhouse segments, with lower price points on average, will remain popular as population growth picks up over the next two years,” said TRREB Chief Market Analyst Jason Mercer. “As population and housing demand continues to grow in the GTA, it will be important to support the fabric of our region’s neighbourhoods. This can be partially accomplished by bringing on line a greater diversity of housing choices. However, in addition, local businesses also need support, and TRREB was encouraged to see the new small business property tax class approved by the City of Toronto. This will be an important tool for post-pandemic recovery,” said TRREB CEO John DiMichele. Mark |

|||

See the season trends in graphical form

I hope this finds you Happy and Healthy!

All the Best!

Mark

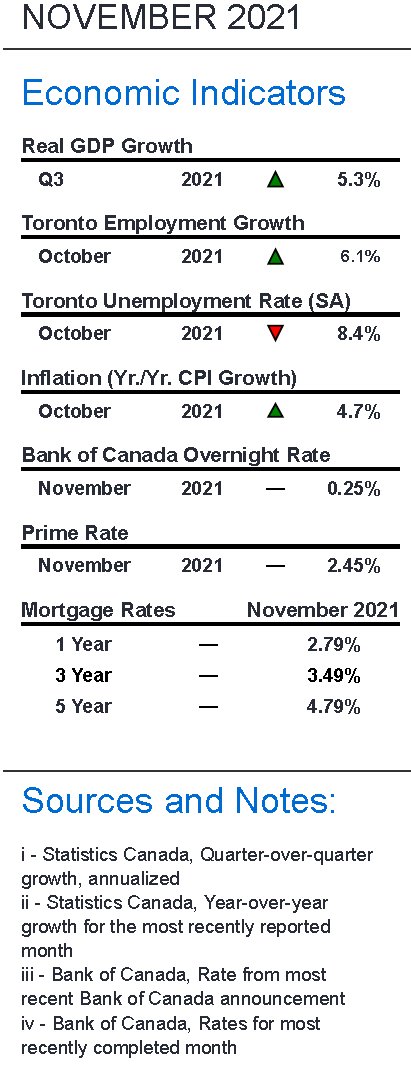

Read about Housing market indicators from last month

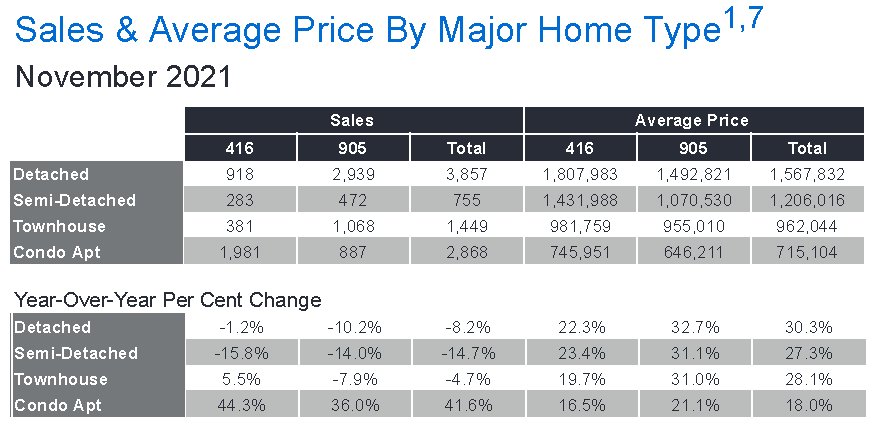

Summary of TorontoMLS Sales and Average Price

Sales by housing type

Below is a Graph showing TRREB Historical Average Price Data

|

|

|

See the Average Price Cycles from January 1995 to Date - a very interesting cyclical pattern is clearly seen!

See how the historical 1 year mortgage interest rate compares to the 5 year rate

This graph shows the 1989 real estate recession in the GTA and how long it took to recover from the drop in the average price from the peak price in February of 1989 to 2002

Statistics Canada, Quarter-over-quarter growth, on an annual basis, Statistics Canada, Year-over-year growth for the most recently reported month, Bank of Canada, Rate from most recent Bank of Canada announcement Bank of Canada, Rates for most recently completed month

Of Mississauga’s 240,660 households, 66,655 or 27.7 per cent were renters in 2016, earning an annual income of $58,272. The average cost of rent and utilities per month for Mississauga renters came in at $1,281 compared to $1,109 for the rest of Ontario.

Notes:

1 - Sales, dollar volume, average sale prices and median sale prices are based on firm transactions entered into the TRREB

MLS® system between the first and last day of the month/period being reported.

2 - New listings entered into the TRREB MLS® system between the first and last day of the month/period being reported.

3 - Active listings at the end of the last day of the month/period being reported.

4 - Ratio of the average selling price to the average listing price for firm transactions entered into the TRREB MLS® system

between the first and last day of the month/period being reported.

5 - Average Listing Days on Market (Avg. LDOM) refers to the average number of days sold listings were on the market.

Average Property Days on Market (Avg. PDOM) refers to the average number of days a property was on the market before

selling irrespective of whether the property was listed more than once by the same combination of seller and brokerage during

the original listing contract period.

6 - Active listings at the end of the last day of the month/period being reported.

7 - Past monthly and year-to-date figures are revised on a monthly basis.

8 - SNLR = Sales-to-New Listings Ratio. Calculated using a 12-month moving average (sales/new listings).

9 - Mos. Inv. = Months of Inventory. Calculated using a 12-month moving average (active listings/sales).

Historic Sales Figures

Rental Market indicators in the GTA

Mississauga MLS Real Estate Properties & MLS.CA Homes for Sale | All Pages including Mississauga Real Estate Blog all maintained by info@mississauga4sale.com Copyright © A. Mark Argentino, P.Eng., Broker, RE/MAX Realty Specialists Inc., Brokerage, Mississauga, Ontario, Canada L5M 7A1 (905) 828-3434 First created - Tuesday, July 16th, 1996 at 3:48:41 PM - Last Update of this website: Thursday, June 1, 2023 6:45 AM

At this Mississauga, (Erin Mills, Churchill Meadows, Sawmill Valley, Credit Mills and or Meadowvale ) Ontario, Canada Real Estate Homes and Property Internet web site you will find relevant information to help you and your family.

Why Subscribe? You will receive valuable Real Estate information on a monthly basis - such as: where to find the 'best' mortgage interest rates, Power of Sale Properties and graphs of current house price trends. Plus, you will pick up ideas, suggestions and excellent real estate advice when you sell or buy your next home.

Read Past Newsletters before you decide |