|  |  |  |  |

Report on last months NewsGTA Resale Housing Sales Up |

|

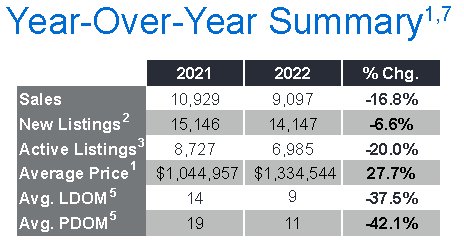

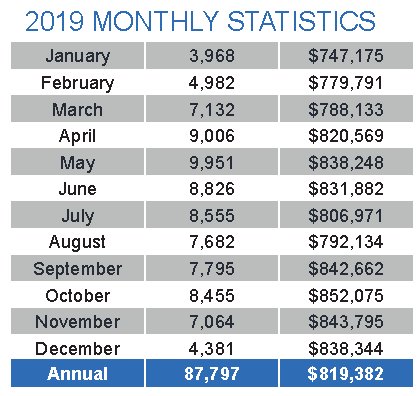

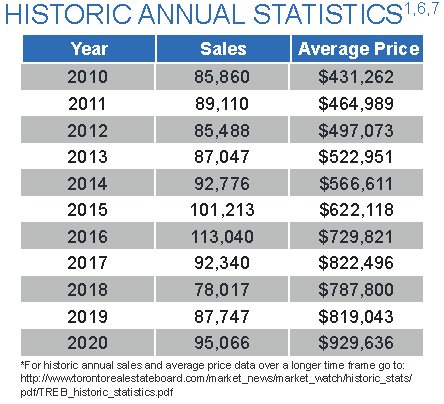

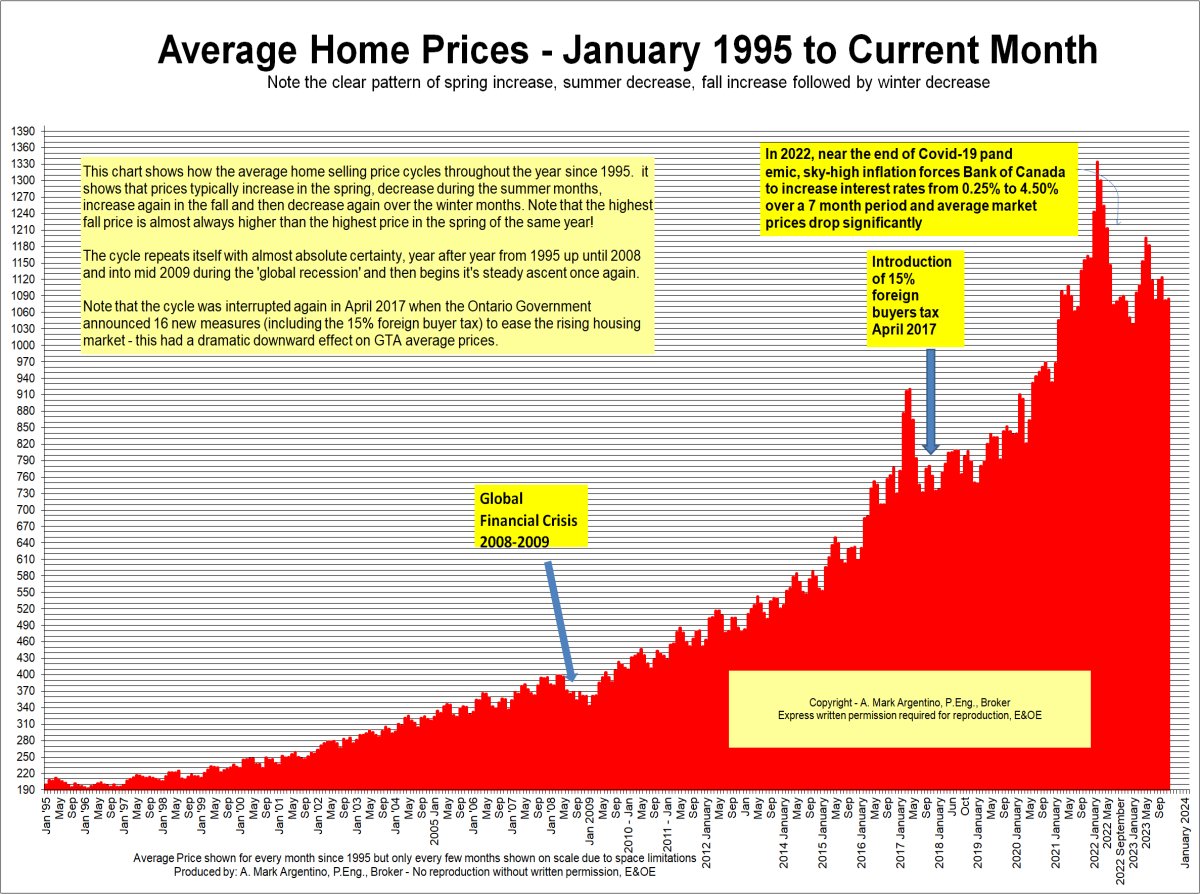

This charts below show the historical annual price and sales volumes to current month:

|

Report as of Monday, March 7, 2022In this Issue of my newsletter |

This is the report for latest month in real estate sales from the Toronto Regional Real Estate Board and indicates a 'normal' amount of activity and price levels.

Below is the latest release of figures

Highlights of the latest report from TRREB for the Residential Real Estate Market in the GTA Real Estate Prices UP and Sales Volume DOWN - Mississauga and GTA Real Estate Newsletter March 2022 - Issue 03:07 This months Real Estate Update brings more positive news from our real estate market here in Mississauga, Toronto and the GTA. Enjoy and I wish you all the best! Mark

See more at this page about average prices and read the TRREB full price and data report below. |

|||

PRESS RELEASE: Sales & Price Growth Continue last monthSee the full press release below. Please refer to this page to see a graph of Average prices and More |

|||

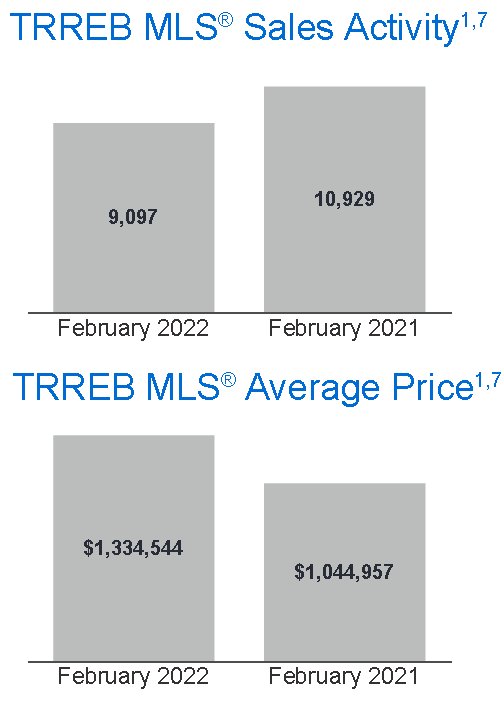

This is the full price and data report from TRREB for last monthGTA REALTORS® RELEASE MONTHLY RESALE HOUSING MARKET FIGURES TRREB RELEASES RESALE MARKET FIGURES AS REPORTED BY GTA REALTORS® GTA REALTORS® RELEASE FEBRUARY STATS TORONTO, ONTARIO, March 3, 2022 – February home sales were down compared to the all-time record in 2021, but represented the second-best result for the month of February in history. New listings dropped, but by a marginally lesser annual rate than sales, pointing to a modest move to a slightly more balanced market. Competition between buyers, however, remained tight enough to support double-digit price growth year-over-year. Greater Toronto Area (GTA) REALTORS® reported 9,097 sales through the Toronto Regional Real Estate Board's (TRREB) MLS® System in February 2022, representing a 16.8 per cent decrease in the number of sales compared to February 2021. The supply of listings for low-rise home types (detached, semi-detached and townhouses) was also down year-over-year, but not by as much as sales. In the condominium apartment segment, particularly in Toronto, new listings were up in comparison to February 2021. “Demand for ownership housing remains strong throughout the GTA, and while we are marginally off the record pace seen last year, any buyer looking in this market is not likely to feel it with competition remaining the norm. Many households sped up their home purchase and entered into a transaction in 2021, which is one reason the number of sales were forecasted to be lower this year and a trending towards higher borrowing cost will have a moderating effect on home sales. Substantial immigration levels and a continued lack of supply, however, will have a countering effect to increasing mortgage costs,” said TRREB President Kevin Crigger. The MLS® Home Price Index Composite Benchmark was up by 35.9 per cent year-over-year in February. The average selling price for all home types combined was up by 27.7 per cent to $1,334,544. The pace of price growth varied by home type and region, but there was relative parity between low-rise and condominium apartment growth rates. “We have seen a slight balancing in the market so far this year, with sales dipping more than new listings. However, because inventory remains exceptionally low, it will take some time for the pace of price growth to slow. Look for a more moderate pace of price growth in the second half of 2022 as higher borrowing costs result in some households putting their home purchase on hold temporarily as they resituate themselves in the market,” said TRREB Chief Market Analyst Jason Mercer. Mark |

|||

See the season trends in graphical form

I hope this finds you Happy and Healthy!

All the Best!

Mark

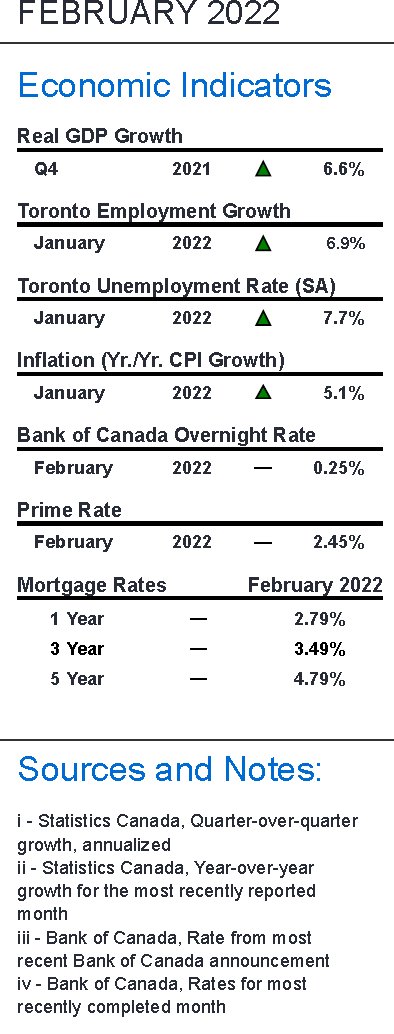

Read about Housing market indicators from last month

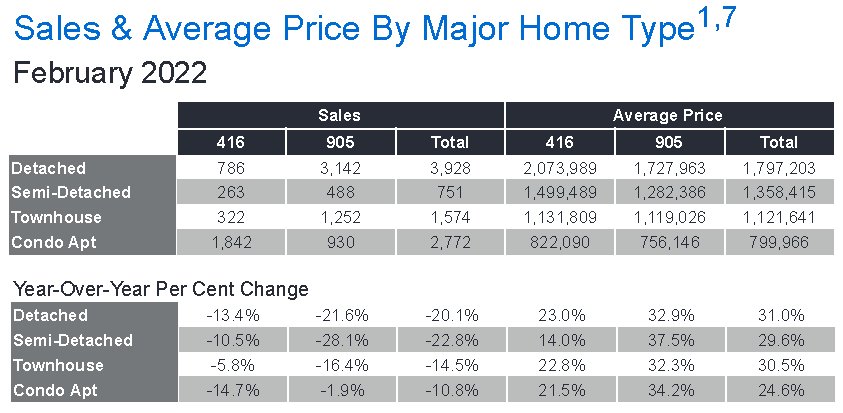

Summary of TorontoMLS Sales and Average Price

Sales by housing type

Below is a Graph showing TRREB Historical Average Price Data

|

|

|

See the Average Price Cycles from January 1995 to Date - a very interesting cyclical pattern is clearly seen!

See how the historical 1 year mortgage interest rate compares to the 5 year rate

This graph shows the 1989 real estate recession in the GTA and how long it took to recover from the drop in the average price from the peak price in February of 1989 to 2002

Statistics Canada, Quarter-over-quarter growth, on an annual basis, Statistics Canada, Year-over-year growth for the most recently reported month, Bank of Canada, Rate from most recent Bank of Canada announcement Bank of Canada, Rates for most recently completed month

Of Mississauga’s 240,660 households, 66,655 or 27.7 per cent were renters in 2016, earning an annual income of $58,272. The average cost of rent and utilities per month for Mississauga renters came in at $1,281 compared to $1,109 for the rest of Ontario.

Notes:

1 - Sales, dollar volume, average sale prices and median sale prices are based on firm transactions entered into the TRREB

MLS® system between the first and last day of the month/period being reported.

2 - New listings entered into the TRREB MLS® system between the first and last day of the month/period being reported.

3 - Active listings at the end of the last day of the month/period being reported.

4 - Ratio of the average selling price to the average listing price for firm transactions entered into the TRREB MLS® system

between the first and last day of the month/period being reported.

5 - Average Listing Days on Market (Avg. LDOM) refers to the average number of days sold listings were on the market.

Average Property Days on Market (Avg. PDOM) refers to the average number of days a property was on the market before

selling irrespective of whether the property was listed more than once by the same combination of seller and brokerage during

the original listing contract period.

6 - Active listings at the end of the last day of the month/period being reported.

7 - Past monthly and year-to-date figures are revised on a monthly basis.

8 - SNLR = Sales-to-New Listings Ratio. Calculated using a 12-month moving average (sales/new listings).

9 - Mos. Inv. = Months of Inventory. Calculated using a 12-month moving average (active listings/sales).

Historic Sales Figures

Rental Market indicators in the GTA

Mississauga MLS Real Estate Properties & MLS.CA Homes for Sale | All Pages including Mississauga Real Estate Blog all maintained by info@mississauga4sale.com Copyright © A. Mark Argentino, P.Eng., Broker, RE/MAX Realty Specialists Inc., Brokerage, Mississauga, Ontario, Canada L5M 7A1 (905) 828-3434 First created - Tuesday, July 16th, 1996 at 3:48:41 PM - Last Update of this website: Thursday, June 1, 2023 6:45 AM

At this Mississauga, (Erin Mills, Churchill Meadows, Sawmill Valley, Credit Mills and or Meadowvale ) Ontario, Canada Real Estate Homes and Property Internet web site you will find relevant information to help you and your family.

Why Subscribe? You will receive valuable Real Estate information on a monthly basis - such as: where to find the 'best' mortgage interest rates, Power of Sale Properties and graphs of current house price trends. Plus, you will pick up ideas, suggestions and excellent real estate advice when you sell or buy your next home.

Read Past Newsletters before you decide |