|  |  |  |  |

Report on last months NewsGTA Resale Housing Sales Up |

In this Issue of my newsletter

This is the report for November from the Toronto real estate board

and indicates a 'normal' amount of activity and price drop for the month

of November.

All the best!

Mark

GTA REALTORS(r) Report Monthly Resale Housing Market Figures

TORONTO, January 6, 2011 -- Greater Toronto REALTORS(r) reported 4,395 existing home sales for the month of December, bringing the 2010 total to 86,170 - down by one per cent compared to 2009.

See the actual figures below.

"Market conditions were anything but uniform in 2010. We went from super-charged sales activity during the first four months of the year, to a marked drop-off in transactions in the summer and then in the fall saw sales climb back to levels that are sustainable over the longer term," said TREB President Bill Johnston.

"New Federal Government-mandated mortgage lending guidelines, higher borrowing costs and misconceptions about the HST caused a pause in home buying in the summer. As it became clear that the HST was not applicable to the sale price of an existing home and buyers realized that home ownership remained affordable, market conditions improved," continued Johnston.

The average home selling price in 2010 was $431,463 - up nine per cent in comparison to the 2009 average selling price of $395,460. In December, the average annual rate of price growth was five per cent.

"At the outset of 2010, we were experiencing annual rates of price growth at or near 20 per cent. This was the result of extremely tight market conditions coupled with the fact that we were comparing prices to the trough of the recession at the beginning of 2009," said Jason Mercer, TREB's Senior Manager of Market Analysis.

"Balanced market conditions in the second half of 2010 resulted in more moderate home price appreciation," continued Mercer. "Expect the average selling price to grow at or below five per cent in 2011. With this type of growth, mortgage carrying costs for the average priced home in the GTA will remain affordable for a household earning an average income."

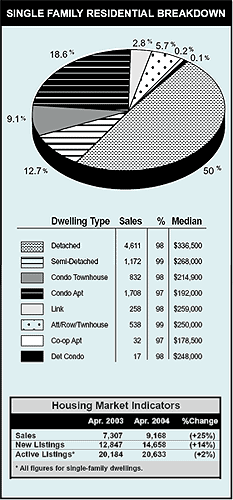

Home sales in the GTA were spread across a number of different housing types in 2010. Detached homes accounted for 49 per cent of total sales. Condominium apartments accounted for an additional 25 per cent per cent of sales. Other housing types including townhomes and semi-detached houses accounted for the final 26 per cent. In some areas like TREB's central districts the mix was quite different, with condominium apartments accounting for 61 per cent of total sales.

"Ownership housing is available in a diversity of types and price points across the GTA, allowing plenty of choice for first time buyers and experienced home buyers alike. This housing diversity is one factor that continues to make the GTA a popular choice for households and businesses," concluded Johnston.

I hope this finds you Happy and Healthy!

All the Best!

Mark

This chart plots the monthly MLS sales for the current year and the previous three years. The recurring seasonal trend can be examined along with comparisons to previous years for each month. Click the chart bellow to see a larger printable version.

This chart plots the monthly MLS average home price for the current year and the previous three years. The recurring seasonal trend can be seen along with comparisons to previous years for each month. You can click the thumbnail below to see a larger printable version. As well, you can see the season trends in graphical form

I hope this finds you Happy and Healthy!

All the Best!

Mark

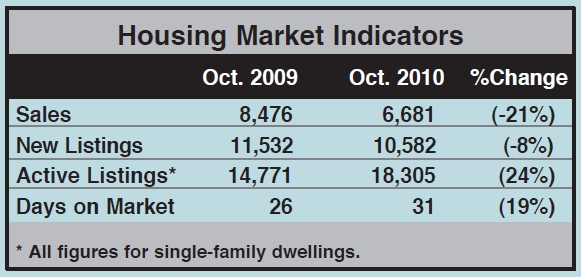

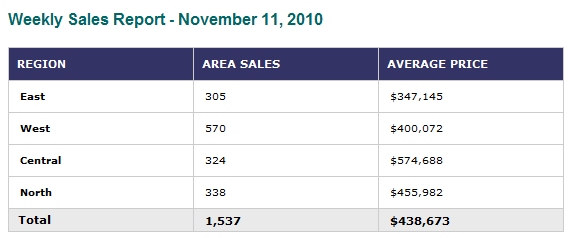

Housing market indicators for November 2010

<

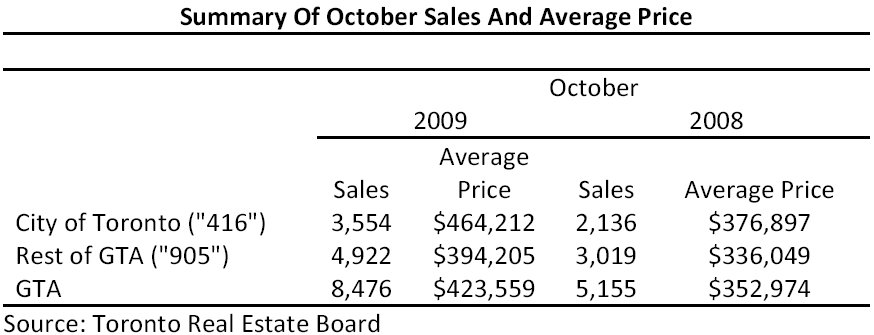

SUMMARY OF October SALES AND AVERAGE PRICE 2009 - 2008

<

Greater Toronto REALTORS® are passionate about their work. They adhere to a strict Code of Ethics and share a state-of-the-art Multiple Listing Service. Serving over 28,000 Members in the Greater Toronto Area, the Toronto Real Estate Board is Canada’s largest real estate board.

Toronto

REALTORS® are passionate about their work. They adhere to a strict code of ethics and share a state-of-the-art Multiple Listing Service designed exclusively for REALTORS®.

Serving more than 24,000 Members in the Greater

Toronto Area, the Toronto Real Estate Board is Canada's

largest real estate board. Greater Toronto Area

open house listings are now available on www.TorontoRealEstateBoard.com.

<

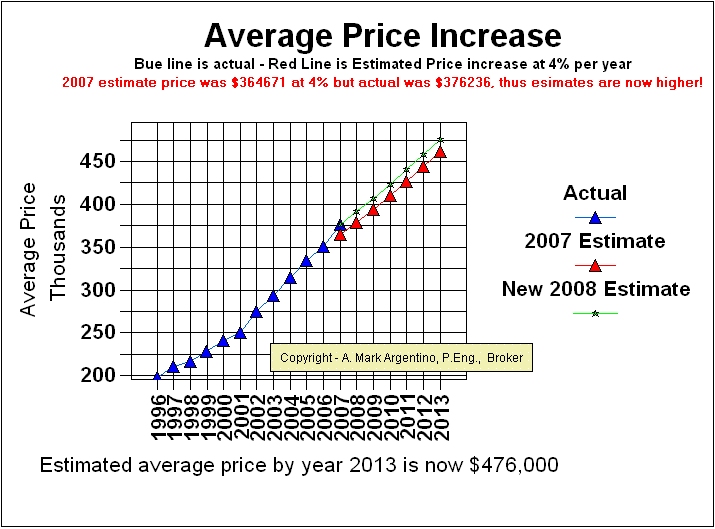

See the Average Price Cycles

from January 1995 to Date - a very interesting cyclical pattern is clearly

seen!

See how the historical 1 year mortgage interest rate

compares to the 5 year rate

Breaking down the total Numbers into TREB Areas for this month

Please browse here if you wish to see all the TREB Sales stats for 2007

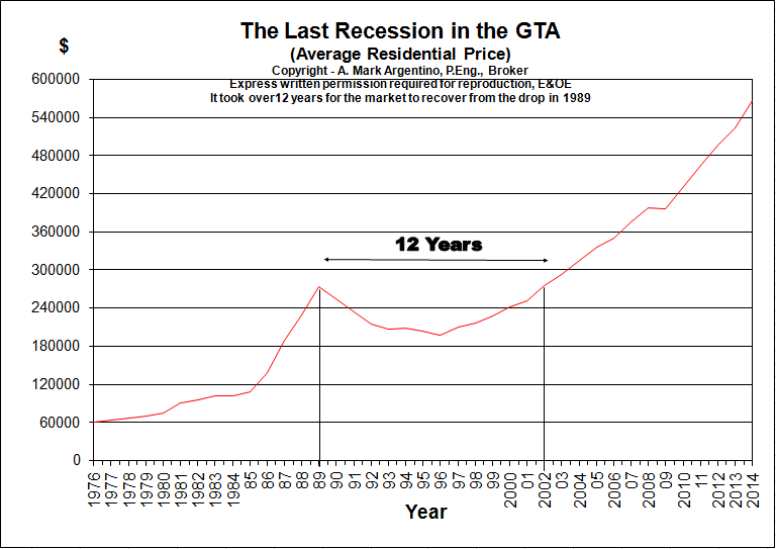

This graph shows the last real estate recession in the GTA and how long it took to recover from the drop in the average price

<

This is a graphical representation showing the percentage of homes that sold in each price range.

Note the shift when you compare this month to 2 years ago,

quite significant!

| August 2010 |

< |

| August of 2008 |

< |

Latest sales report for November 2010

<

latest Sales

Report - August 26, 2010

| RegION |

Area

Sales |

Average

Price |

|---|---|---|

East |

329 |

$327,637 |

West |

555 | $392,685 |

Central |

266 |

$454,598 |

North |

337 |

$475,755 |

Total |

1,487 |

$408,194 |

NOTE: Please note these are preliminary figures. Minor adjustments may be required at month's end.

January

22, 2009 |

|||

Region |

Area Sales |

Av. Price |

|

East |

123 |

$278,453 |

|

West |

221 |

$323,384 |

|

Central |

88 |

$432,270 |

|

North |

93 |

$375,131 |

|

Total |

525 |

$340,275 |

|

NOTE: Please note these are preliminary figures. Minor adjustments may be required at month's end. |

|||

February

28, 2008 |

|||

Region |

Area Sales |

Average Price |

|

East |

391 |

$300,867 |

|

West |

627 |

$358,062 |

|

Central |

268 |

$504,817 |

|

North |

300 |

$419,670 |

|

Total |

1,586 |

$380,654 |

|

NOTE: Please note these are preliminary figures. Minor adjustments may be required at month's end. |

|||

* All figures above for Single-Family Dwellings.

Spot sales figures

Last month December 2008 Sales figures

Neighbourhood Corner - Mississauga - Each month The Toronto Real Estate Board profiles a neighbourhood and for January of 2006 TREB chose Mississauga!

There were 647 sales in Mississauga this January, a decline of three per cent over the first month of 2007. The average price came in at $339,655, a one per cent increase over the same time-frame last year. Of these sales, 196 were of detached homes which averaged $516,190, up eight per cent over January '07.

Mississauga (MLS districts W12 to W20) had 608 sales in January, up seven per cent over the figure recorded in January of 2005. These sales averaged $305,464, a two per cent increase over last January. Breaking down the total, there were 201 sales of detached homes, which averaged $448,889; there were 171 sales of condominium apartments, and the average for these was $193,481.

There were 569 sales in the Mississauga area during January, down 12 per cent from the figure recorded in January of 2004. The average price, however, rose seven per cent to $298,503. Breaking down the total, detached homes in Mississauga (203 sales) averaged about $418,655, while semis (121 sales) came in at $279,025.

The Mississauga area (W-12 through W-20) registered 645 sales in January, down 10 per cent from the 721 recorded during the same time-frame in 2003. However, the overall average in Mississauga came to $277,594, up seven percent over the $259,207 recorded in January of last year. Average days-on-market was 43, about the same as the Board-wide figure of 42.

In Mississauga (W-12 to W-20) the latter half of this year saw prices climb 10 per cent to $256,824 over the $233,151 recorded for the whole of 2001. Average Days-on-Market in Mississauga was 34, as compared to a city-wide average of 38 days.

Rental Market indicators in the GTA

This chart shows the breakdown of single family residential sales

for last month.

<

Excellent, I am ready for an online evaluation

| |

Mississauga MLS Real Estate Properties & MLS.CA Homes for Sale | All Pages including Mississauga Real Estate Blog all maintained by info@mississauga4sale.com Copyright © A. Mark Argentino, P.Eng., Broker, RE/MAX Realty Specialists Inc., Brokerage, Mississauga, Ontario, Canada L5M 7A1 (905) 828-3434 First created - Tuesday, July 16th, 1996 at 3:48:41 PM - Last Update of this website: Thursday, June 1, 2023 6:45 AM

At this Mississauga, (Erin Mills, Churchill Meadows, Sawmill Valley, Credit Mills and or Meadowvale ) Ontario, Canada Real Estate Homes and Property Internet web site you will find relevant information to help you and your family.

Why Subscribe? You will receive valuable Real Estate information on a monthly basis - such as: where to find the 'best' mortgage interest rates, Power of Sale Properties and graphs of current house price trends. Plus, you will pick up ideas, suggestions and excellent real estate advice when you sell or buy your next home.

Read Past Newsletters before you decide |