|  |  |  |  |

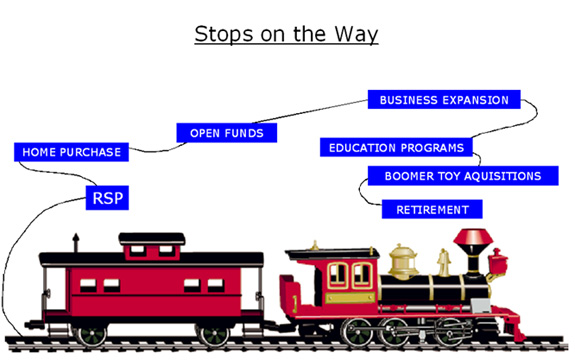

Fundamentals for using building blocks from your RSP to buy a home. The Canadian Homebuyers' Plan allows you to borrow funds from your Registered Retirement

Saving Plan (RRSP or RSP for short) to buy your first home. If you qualify,

you and your spouse can each borrow up to $20,000 from your Registered Retirement

Savings Plans to use as a down payment on a home. Combined, that's a total

of $40,000 that may be available to you. You then have 15 years to repay your

RRSP.

Here's what you need to know:

Even if you have already saved for your down payment, it may make good financial sense to access your savings through the Home Buyers' Plan. For example, if you had already saved $20,000 for a down payment - and assuming you still had enough "contribution room" in your RRSP for a contribution of that amount you could move your savings into a registered investment at least 90 days before your closing date. Then, simply withdraw the money through the Home Buyers' Plan.

The advantage? Your $20,000 RRSP contribution will count as a tax deduction

this year. Use any tax refund you receive to repay the RRSP or other expenses

related to buying your home.

While using your RRSP for a down payment may help you buy a home sooner, it can also mean missing out on some tax-sheltered growth. So be sure to ask your financial planner whether this strategy makes sense for you, given your personal financial situation.

To provide a savings plan and refundable tax credit that helps lower-income individuals and couples (married or in a common-law partnership) save towards the purchase of a first home.

The Income Tax Related Programs Branch in the Tax Revenue Division of the Ministry of Finance administers the OHOSP program, in partnership with participating financial institutions.

Contributions to OHOSP's are made at participating financial institutions. Joint OHOSP's are not available, so each spouse or common-law partner may open a separate plan.

Claim your tax credit on the ON 479 Ontario Credits form included with your federal income tax return.

The Land Transfer Tax Refund Program, available to purchasers of newly constructed homes only, is administered by the Motor Fuels and Tobacco Tax Branch in the Tax Revenue Division of the Ministry of Finance.

Of course, there are

"

Mark's 5 WRITTEN Guarantees " just in case you are not convinced yet that Mark

is the right Agent for you!

Excellent, I am ready to begin my home search

Mississauga MLS Real Estate Properties & MLS.CA Homes for Sale | All Pages including Mississauga Real Estate Blog all maintained by info@mississauga4sale.com Copyright © A. Mark Argentino, P.Eng., Broker, RE/MAX Realty Specialists Inc., Brokerage, Mississauga, Ontario, Canada L5M 7A1 (905) 828-3434 First created - Tuesday, July 16th, 1996 at 3:48:41 PM - Last Update of this website: Tuesday, April 9, 2024 7:24 AM

At this Mississauga, (Erin Mills, Churchill Meadows, Sawmill Valley, Credit Mills and or Meadowvale ) Ontario, Canada Real Estate Homes and Property Internet web site you will find relevant information to help you and your family.

Why Subscribe? You will receive valuable Real Estate information on a monthly basis - such as: where to find the 'best' mortgage interest rates, Power of Sale Properties and graphs of current house price trends. Plus, you will pick up ideas, suggestions and excellent real estate advice when you sell or buy your next home.

Read Past Newsletters before you decide |