|  |  |  |  |

Report on last months NewsGTA Resale Housing Sales Up |

|

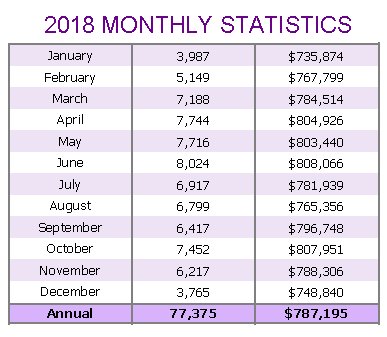

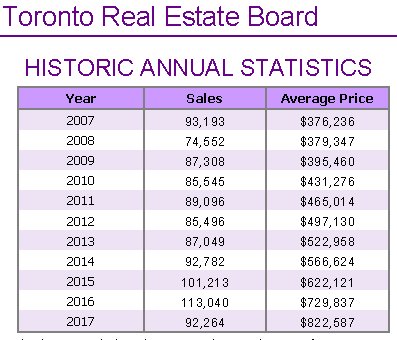

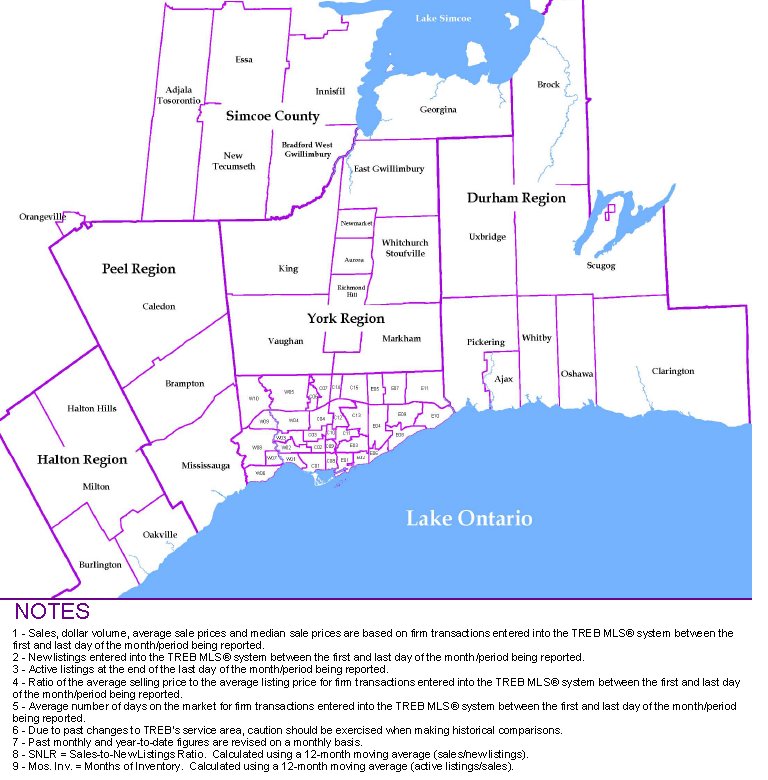

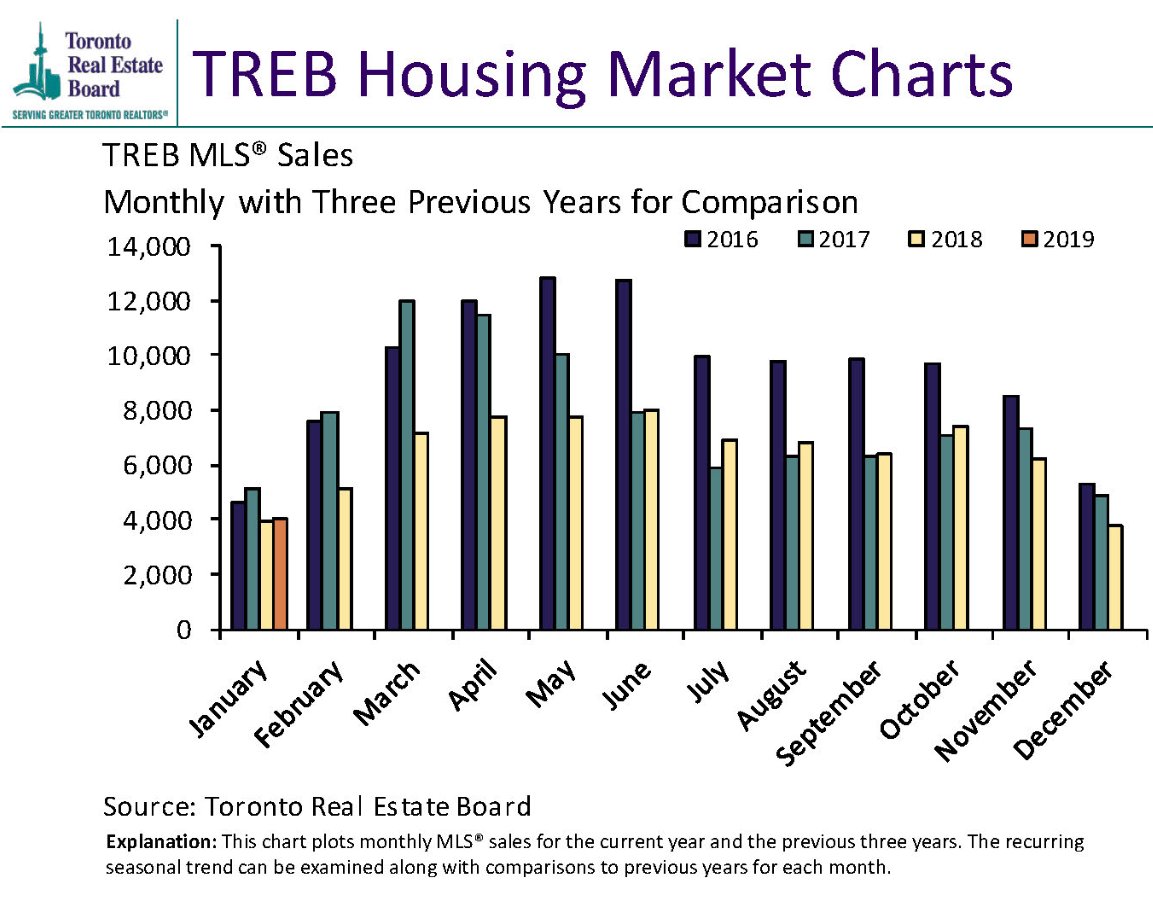

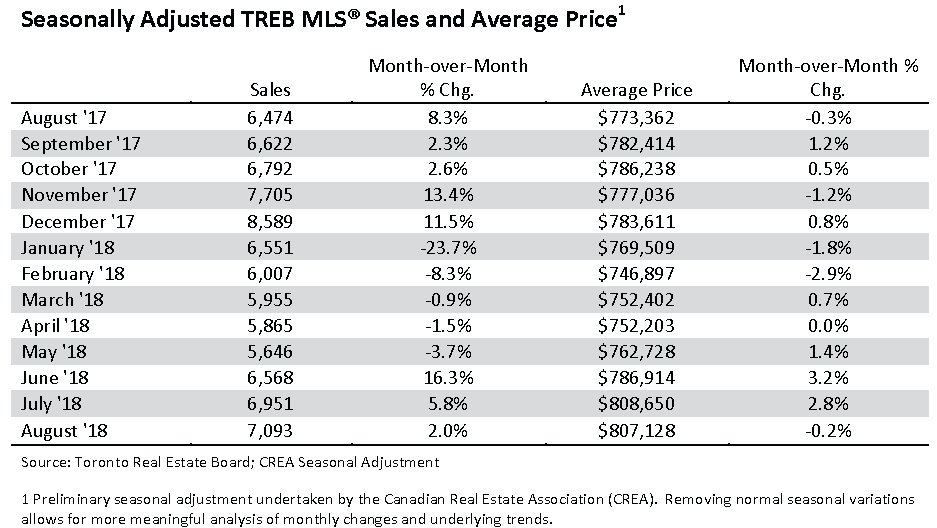

This charts below show the historical annual price and sales volumes to current month:

|

Report as of Tuesday, March 5, 2019In this Issue of my newsletter |

This is the report for latest month in real estate sales from the Toronto real estate board and indicates a 'normal' amount of activity and price levels.

Below is the latest release of figures

Highlights of the latest report from TREB for the Residential Real Estate Market in the GTA

See more at this page about average prices and read the TREB full price and data report below. |

|

PRESS RELEASE: Sales & Price Growth Continue last monthSee the full press release below. Please refer to this page to see a graph of Average prices and More |

|

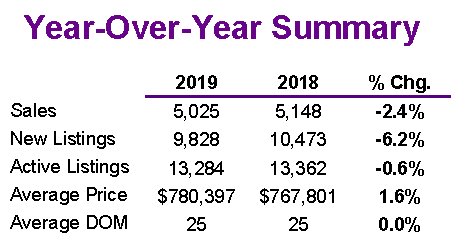

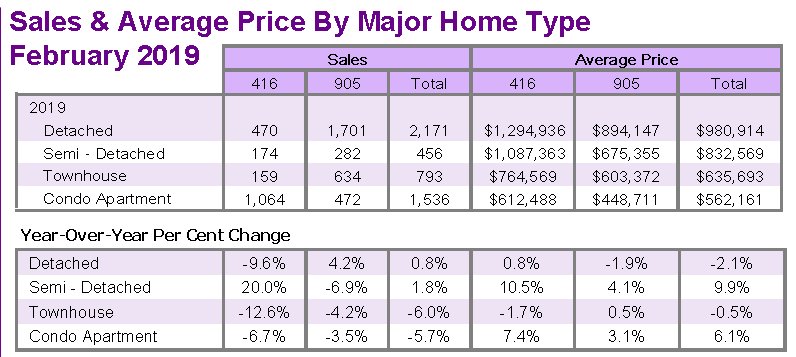

This is the full price and data report from TREB for last monthGTA REALTORS® RELEASE MONTHLY RESALE HOUSING MARKET FIGURES TREB RELEASES RESALE MARKET FIGURES AS REPORTED BY GTA REALTORS® TORONTO, ONTARIO, March 5, 2019 – Toronto Real Estate Board President Gurcharan (Garry) Bhaura announced that Greater Toronto Area REALTORS® reported 5,025 homes sold through TREB’s MLS® System in February 2019. This sales total was down by 2.4 per cent on a year-overyear basis. Sales were also down compared to January 2019 following preliminary seasonal adjustment. “The OSFI mandated mortgage stress test has left some buyers on the sidelines who have struggled to qualify for the type of home they want to buy. The stress test should be reviewed and consideration should be given to bringing back 30 year amortizations for federally insured mortgages. There is a federal budget and election on the horizon. It will be interesting to see what policy measures are announced to help with home ownership affordability,” said Mr. Bhaura. Despite sales being down year-over-year, new listings actually declined by a greater annual rate. This suggests that market conditions became tighter compared to last year. Tighter market conditions continued to support year-over-year average price growth. Both the MLS® Home Price Index Composite Benchmark and the average selling price were up modestly on a year-over-year basis in February 2019. The MLS® HPI Composite Benchmark was up by 2.4 per cent year-over-year. The average selling price for all home types combined was up by 1.6 per cent over the same period. Price growth was driven by the condominium apartment segment and higher density low-rise home types. On a preliminary seasonally adjusted basis the average selling price was down compared to January 2019. “Home sales reported through TREB’s MLS® System have a substantial impact on the Canadian economy. A study conducted by Altus for TREB found that, on average, each home sale reported through TREB resulted in $68,000 in spin-off expenditures accruing to the economy. With sales substantially lower than the 2016 record peak over the last two years, we have experienced a hit to the economy in the billions of dollars, in the GTA alone. This hit has also translated into lower government revenues and, if sustained, could impact the employment picture as well,” said Jason Mercer, TREB’s Director of Market Analysis and Service Channels. The rental market continued to operate in a high demand, low inventory environment during the first two months of 2019. Strong competition between renters resulted in average rents for onebedroom and two-bedroom apartments leased through TREB’s MLS® System increasing wellabove the rate of inflation on a year-over-year basis for the January-February period. The average one-bedroom rent was up by 8.1 per cent to $2,145. The average two-bedroom rent was up by 7.4 per cent to $2,810. “With vacancy rates hovering in the one per cent range and average rents increasing in the high single digits, it is clear that signing a lease for a rental unit is not an easy proposition in the GTA. While some rent control provisions have been relaxed by the new provincial government, policy makers need to look at further initiatives to encourage rather than discourage investment in rental apartments. A recent Ipsos survey conducted for TREB found that almost one-quarter of investment property owners are very likely to list their property for sale this year, which is concerning in an already tight rental market,” said TREB CEO John DiMichele. All the Best! Mark |

|

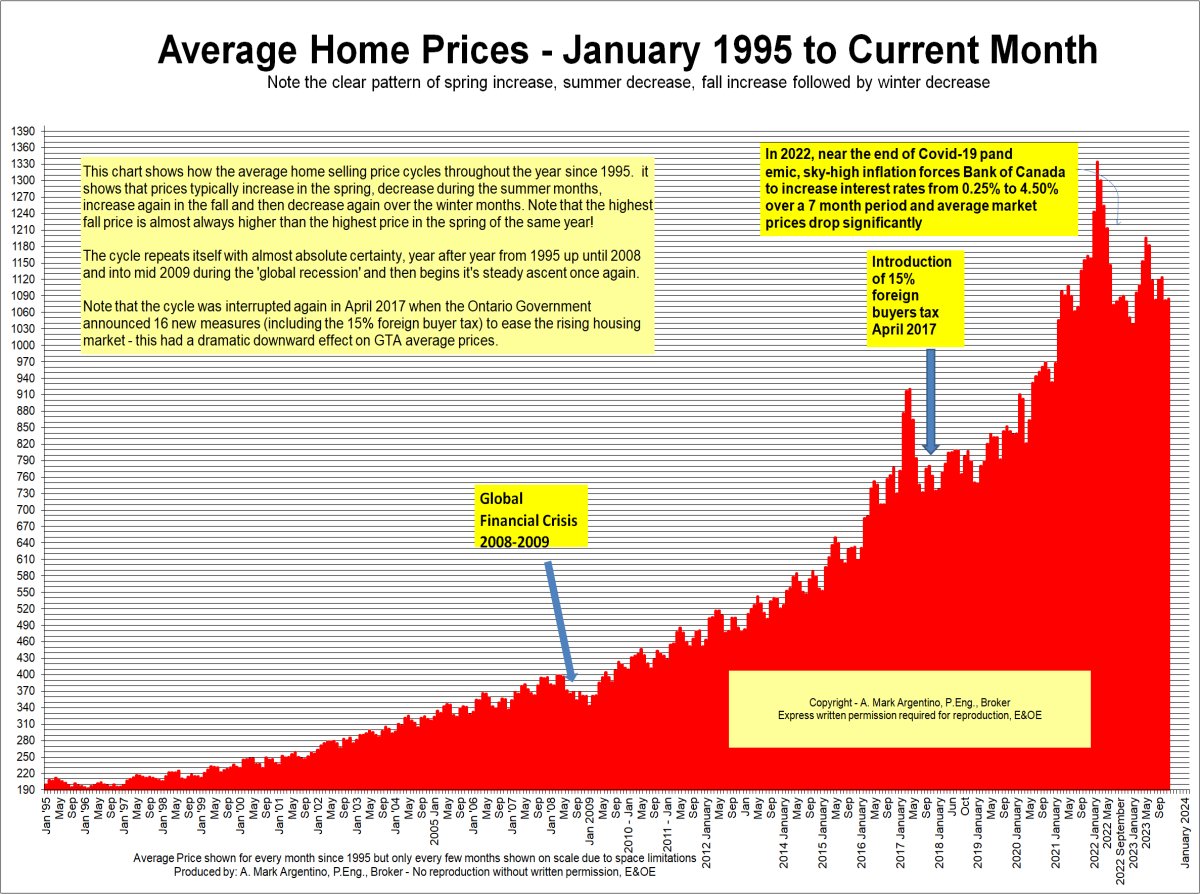

This chart plots the monthly MLS average home price for the current year and the previous three years. The recurring seasonal trend can be seen along with comparisons to previous years for each month. You can click the thumbnail below to see a larger printable version. As well, you can see the season trends in graphical form

I hope this finds you Happy and Healthy!

All the Best!

Mark

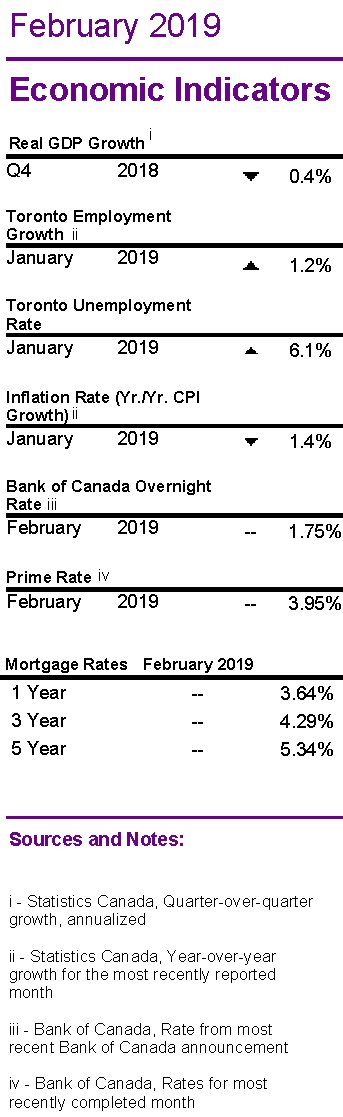

Read about Housing market indicators from last month

Summary of TorontoMLS Sales and Average Price

Sales by housing type

Below is a Graph showing TREB Historical Average Price Data

|

|

|

See the Average Price Cycles from January 1995 to Date - a very interesting cyclical pattern is clearly seen!

See how the historical 1 year mortgage interest rate compares to the 5 year rate

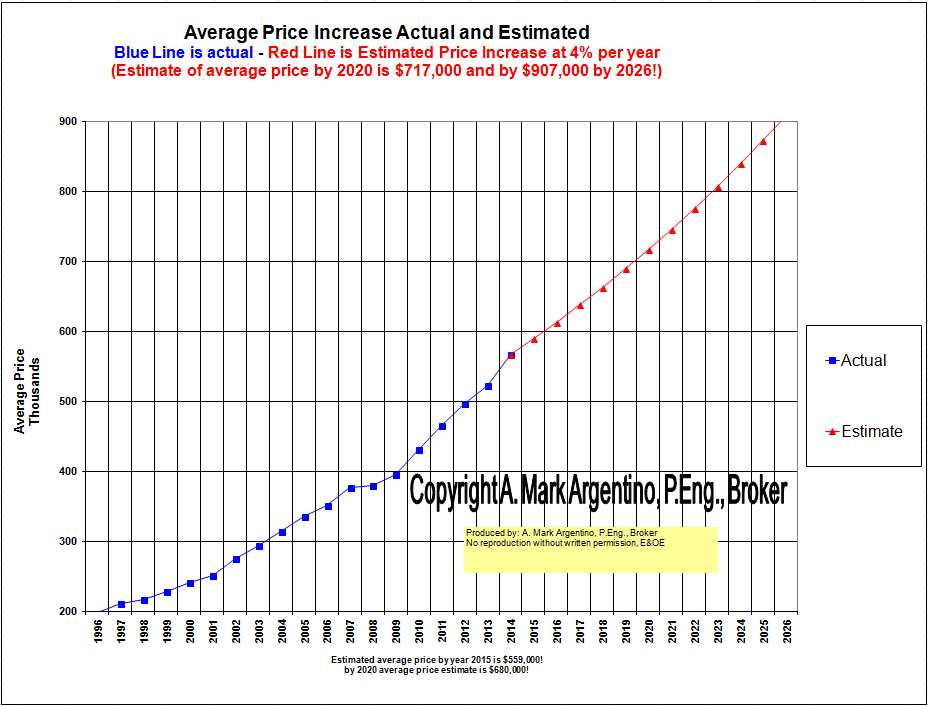

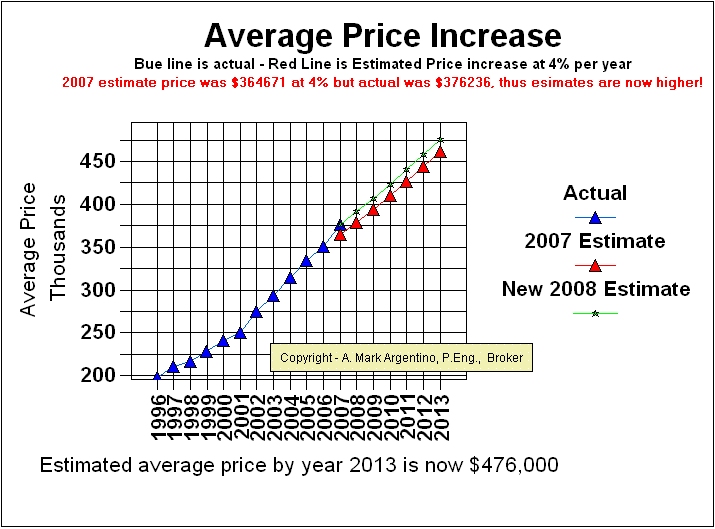

Update: The figures are in for 2012 and the average price was $479,000, I've updated the graph below to reflect these changes....stay tuned!

Below is the estimate as of 2012

Breaking down the total Numbers into TREB Areas for this month

Please browse here if you wish to see all the TREB Sales stats for 2007

This graph shows the 1989 real estate recession in the GTA and how long it took to recover from the drop in the average price from the peak price in February of 1989 to 2002

Statistics Canada, Quarter-over-quarter growth, on an annual basis, Statistics Canada, Year-over-year growth for the most recently reported month, Bank of Canada, Rate from most recent Bank of Canada announcement Bank of Canada, Rates for most recently completed month

Of Mississauga’s 240,660 households, 66,655 or 27.7 per cent were renters in 2016, earning an annual income of $58,272. The average cost of rent and utilities per month for Mississauga renters came in at $1,281 compared to $1,109 for the rest of Ontario.

Historic Sales Figures

Rental Market indicators in the GTA

This chart shows the breakdown of single family residential sales (detached, semi's, townhomes and condos) for last month.

TREB MLS® Active Residential Listings at Month-‐End

Excellent, I am ready for an online evaluation

Mississauga MLS Real Estate Properties & MLS.CA Homes for Sale | All Pages including Mississauga Real Estate Blog all maintained by info@mississauga4sale.com Copyright © A. Mark Argentino, P.Eng., Broker, RE/MAX Realty Specialists Inc., Brokerage, Mississauga, Ontario, Canada L5M 7A1 (905) 828-3434 First created - Tuesday, July 16th, 1996 at 3:48:41 PM - Last Update of this website: Thursday, June 1, 2023 6:45 AM

At this Mississauga, (Erin Mills, Churchill Meadows, Sawmill Valley, Credit Mills and or Meadowvale ) Ontario, Canada Real Estate Homes and Property Internet web site you will find relevant information to help you and your family.

Why Subscribe? You will receive valuable Real Estate information on a monthly basis - such as: where to find the 'best' mortgage interest rates, Power of Sale Properties and graphs of current house price trends. Plus, you will pick up ideas, suggestions and excellent real estate advice when you sell or buy your next home.

Read Past Newsletters before you decide |