|  |  |  |  |

Report on last months NewsGTA Resale Housing Sales Up |

|

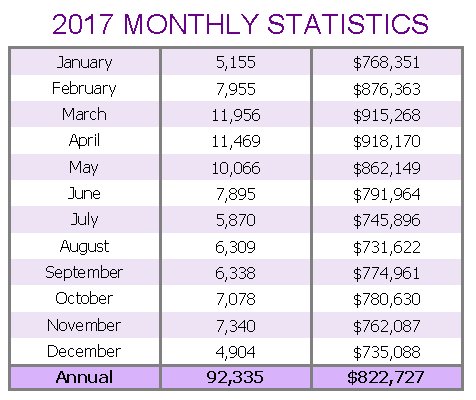

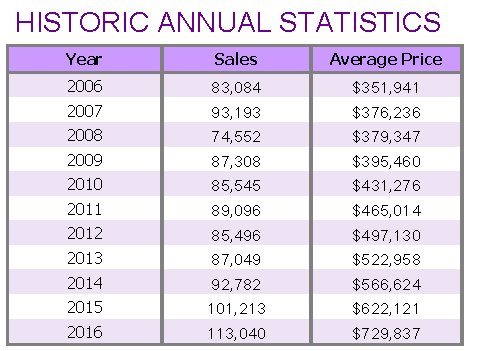

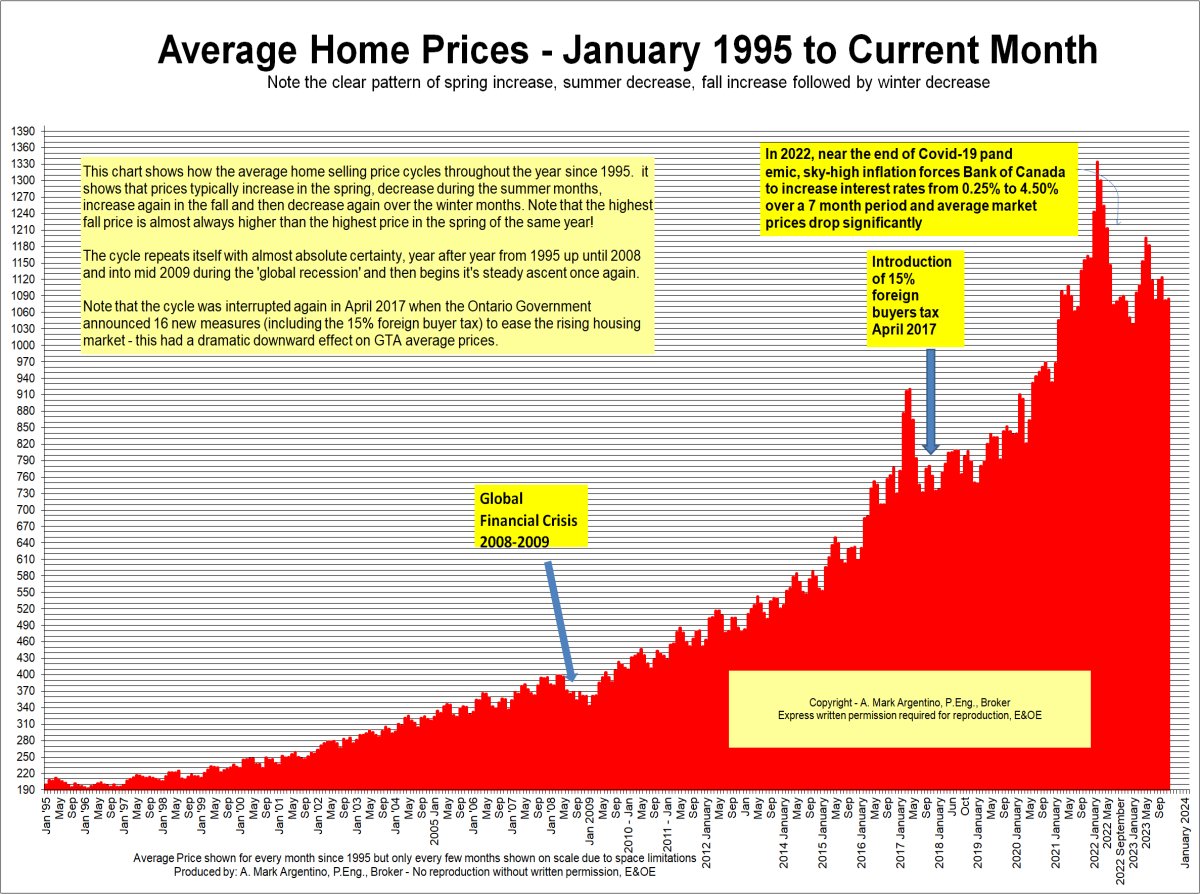

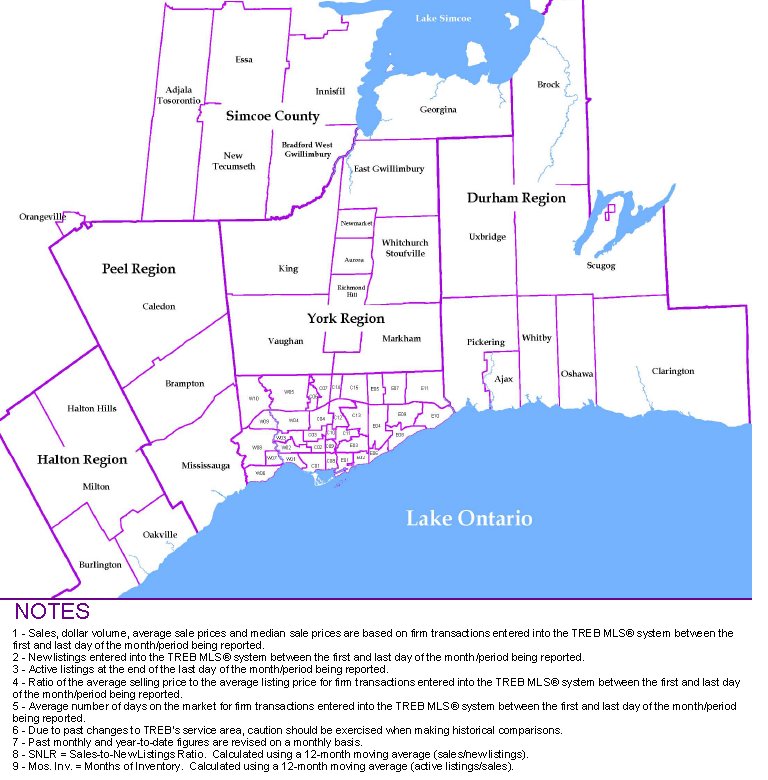

This charts below show the historical annual price and sales volumes to current month:

|

Report as of Monday, November 5, 2018In this Issue of my newsletter |

This is the report for latest month in real estate sales from the Toronto real estate board and indicates a 'normal' amount of activity and price levels.

Below is the latest release of figures

Highlights of the latest report from TREB for the Residential Real Estate Market in the GTA

See more at this page about average prices and read the TREB full price and data report below. |

|

PRESS RELEASE: Sales & Price Growth Continue last monthSee the full press release below. Please refer to this page to see a graph of Average prices and More |

|

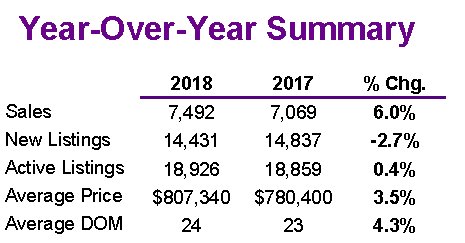

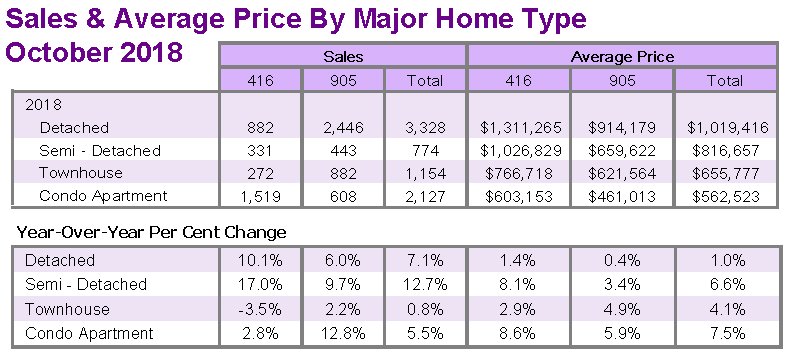

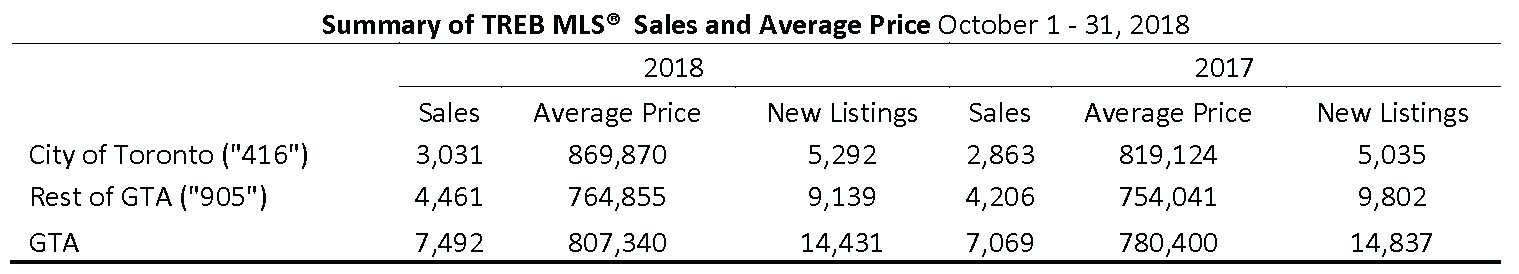

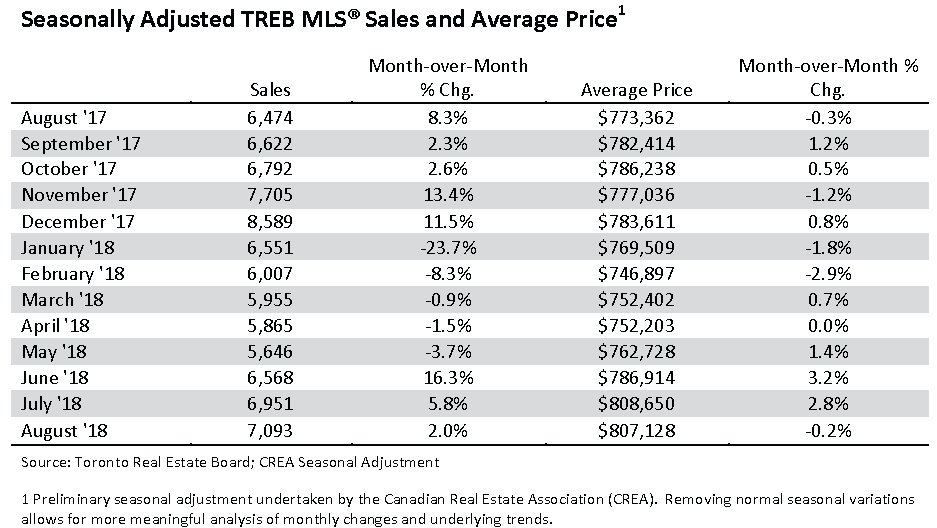

This is the full price and data report from TREB for last monthGTA REALTORS® RELEASE MONTHLY RESALE HOUSING MARKET FIGURES GTA REALTORS® RELEASE MONTHLY RESALE MARKET WATCH REPORT Greater Toronto, November 5, 2018 – Toronto Real Estate Board President Garry Bhaura announced year-over-year increases in home sales and average sale prices reported through TREB’s MLS® System in October 2018. Greater Toronto Area REALTORS® reported 7,492 sales through TREB’s MLS® System in October 2018 – a six per cent increase compared to October 2017. On a preliminary seasonally adjusted basis, sales were down by one per cent compared to September 2018. The average sale price for October 2018 was up 3.5 per cent on a year-over-year basis to $807,340. After preliminary seasonal adjustment, the average selling price was up one per cent compared to September 2018. The MLS® Home Price Index (HPI) Composite Benchmark was up by 2.6 per cent compared to October 2017. Price growth continued to be driven be the condominium apartment and higher density lowrise market segments. “Annual sales growth has been positive since the late spring. While the OSFI stress test and higher borrowing costs have kept sales below 2016’s record pace, many households in the Greater Toronto Area remain upbeat on home ownership as a quality long-term investment. A strong regional economy and steady population growth will continue to support the demand for housing ownership as we move into 2019,” said Mr. Bhaura. There were 14,431 new Listings entered into TREB’s MLS® System in October 2018 – down 2.7 per cent compared to October 2017. The fact that sales were up and new listings were down year-over-year in October suggests that market conditions became tighter. “Annual sales growth has outstripped annual growth in new listings for the last five months, underpinning the fact that listings supply remains an issue in the Greater Toronto Area. With municipal elections in the rear view mirror, all levels of government need to concentrate on policies that could remove impediments to a better-supplied housing market, including facilitating the development of a broader array of medium density housing choices,” said Jason Mercer, TREB’s Director of Market Analysis. “TREB remains committed to high quality housing research. We will be releasing our fourth annual Market Year in Review and Outlook Report at the beginning of February 2019. The report will include updated consumer survey results, including home buying intentions for 2019, and exciting new research related to housing supply,” added Mr. Bhaura. All the Best! Mark |

|

This chart plots the monthly MLS average home price for the current year and the previous three years. The recurring seasonal trend can be seen along with comparisons to previous years for each month. You can click the thumbnail below to see a larger printable version. As well, you can see the season trends in graphical form

I hope this finds you Happy and Healthy!

All the Best!

Mark

Read about Housing market indicators from last month

Summary of TorontoMLS Sales and Average Price

Sales by housing type

Below is a Graph showing TREB Historical Average Price Data

|

|

|

See the Average Price Cycles from January 1995 to Date - a very interesting cyclical pattern is clearly seen!

See how the historical 1 year mortgage interest rate compares to the 5 year rate

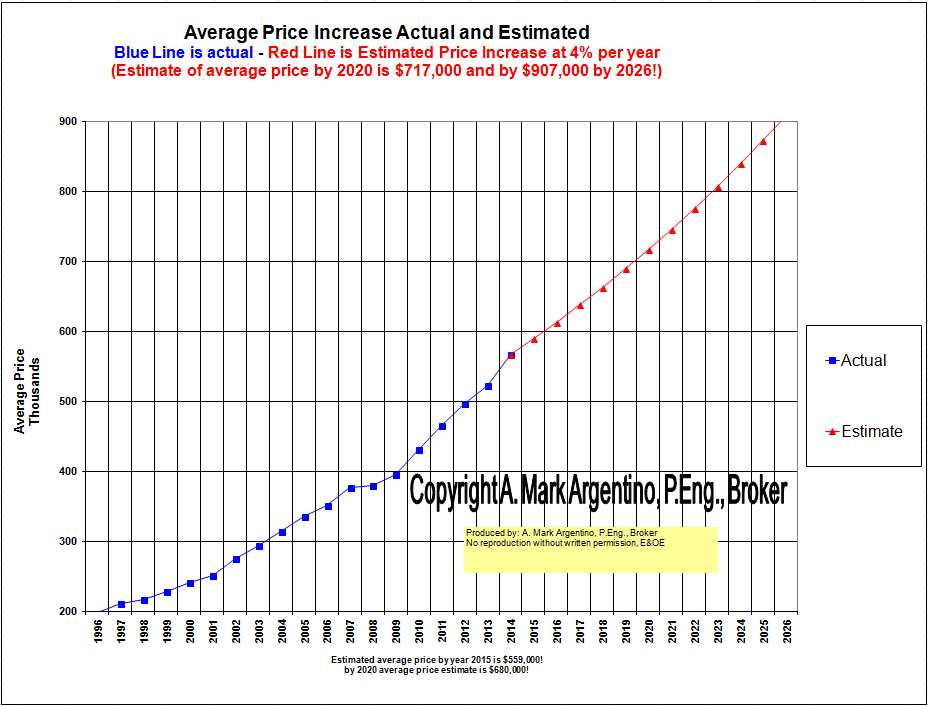

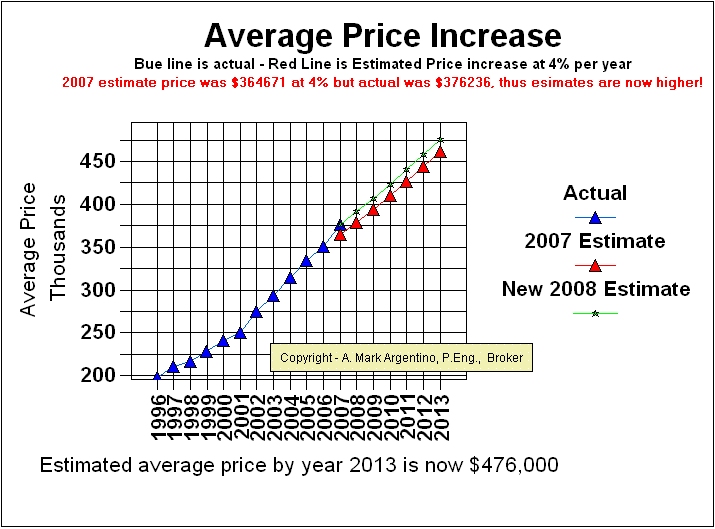

Update: The figures are in for 2012 and the average price was $479,000, I've updated the graph below to reflect these changes....stay tuned!

Below is the estimate as of 2012

Breaking down the total Numbers into TREB Areas for this month

Please browse here if you wish to see all the TREB Sales stats for 2007

This graph shows the 1989 real estate recession in the GTA and how long it took to recover from the drop in the average price from the peak price in February of 1989 to 2002

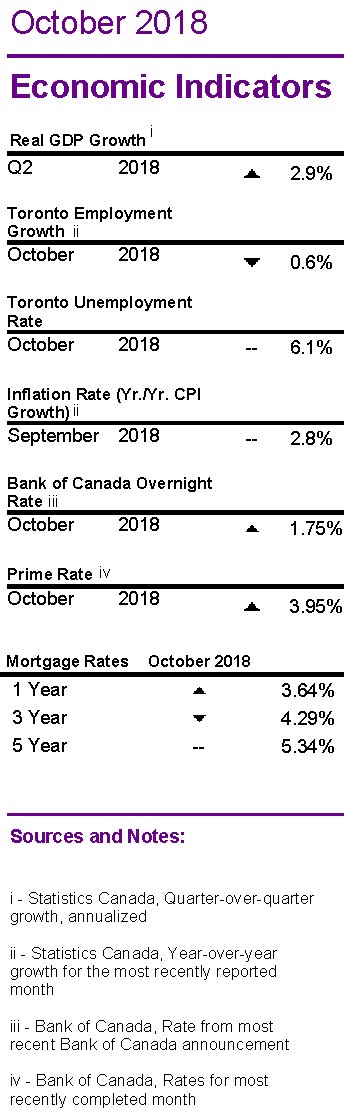

Statistics Canada, Quarter-over-quarter growth, on an annual basis, Statistics Canada, Year-over-year growth for the most recently reported month, Bank of Canada, Rate from most recent Bank of Canada announcement Bank of Canada, Rates for most recently completed month

Of Mississauga’s 240,660 households, 66,655 or 27.7 per cent were renters in 2016, earning an annual income of $58,272. The average cost of rent and utilities per month for Mississauga renters came in at $1,281 compared to $1,109 for the rest of Ontario.

Historic Sales Figures

Rental Market indicators in the GTA

This chart shows the breakdown of single family residential sales (detached, semi's, townhomes and condos) for last month.

TREB MLS® Active Residential Listings at Month-‐End

Excellent, I am ready for an online evaluation

Mississauga MLS Real Estate Properties & MLS.CA Homes for Sale | All Pages including Mississauga Real Estate Blog all maintained by info@mississauga4sale.com Copyright © A. Mark Argentino, P.Eng., Broker, RE/MAX Realty Specialists Inc., Brokerage, Mississauga, Ontario, Canada L5M 7A1 (905) 828-3434 First created - Tuesday, July 16th, 1996 at 3:48:41 PM - Last Update of this website: Thursday, June 1, 2023 6:45 AM

At this Mississauga, (Erin Mills, Churchill Meadows, Sawmill Valley, Credit Mills and or Meadowvale ) Ontario, Canada Real Estate Homes and Property Internet web site you will find relevant information to help you and your family.

Why Subscribe? You will receive valuable Real Estate information on a monthly basis - such as: where to find the 'best' mortgage interest rates, Power of Sale Properties and graphs of current house price trends. Plus, you will pick up ideas, suggestions and excellent real estate advice when you sell or buy your next home.

Read Past Newsletters before you decide |